Understanding the difference between accounting principles and accounting policies is crucial for anyone involved in financial reporting and analysis.

While both are essential components of accounting, they serve distinct roles and purposes within the field. This overview will highlight their definitions, key differences, and the significance of each in the context of financial statement preparation.

Accounting Principles

Accounting principles refer to the fundamental guidelines and rules that govern the field of accounting. They form the theoretical foundation upon which accounting practices and standards are built.

Accounting principles are generally accepted by the accounting community and ensure consistency, reliability, and comparability of financial statements. They include:

- Historical Cost Principle: Assets should be recorded at their original purchase price.

- Revenue Recognition Principle: Revenue should be recognized when it is earned and realizable.

- Matching Principle: Expenses should be matched with the revenues they help to generate.

- Full Disclosure Principle: Financial statements should disclose all information that is necessary for users to make informed decisions.

- Conservatism Principle: When choosing between two solutions, the one that will be least likely to overstate assets and income should be selected.

These principles are often codified in frameworks such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Accounting Policies

Accounting policies, on the other hand, are the specific methods and procedures a company uses to apply accounting principles to its financial statements. These policies are chosen by the company’s management and may vary between companies, even within the same industry. They detail how a company will record and report its financial transactions, ensuring compliance with accounting principles while also reflecting the unique aspects of its business operations. Examples of accounting policies include:

- Inventory Valuation Method: Choosing between FIFO (First-In, First-Out), LIFO (Last-In, First-Out), or weighted average cost.

- Depreciation Method: Selecting a method for allocating the cost of tangible assets over their useful lives, such as straight-line, declining balance, or units of production.

- Revenue Recognition: Deciding on the specific criteria and timing for recognizing revenue, especially in industries with complex transactions.

- Allowance for Doubtful Accounts: Setting criteria for estimating and recording bad debts.

- Capitalization Policy: Establishing thresholds and rules for capitalizing versus expensing certain costs.

Key Differences

Accounting principles and accounting policies differ in several key aspects, including their nature, scope, authority, and flexibility. Understanding these differences is crucial for accurately interpreting and preparing financial statements.

- Nature: The nature of accounting principles and policies highlights the distinction between broad guidelines and specific procedures.

- Principles: Broad, foundational concepts that guide overall accounting practice.

- Policies: Specific, detailed rules and procedures developed by a company to apply those principles in practice.

- Scope: The scope of accounting principles and policies delineates the universal applicability of principles versus the tailored nature of policies.

- Principles: Universal and consistent across different companies and jurisdictions, subject to the adoption of specific frameworks like GAAP or IFRS.

- Policies: Unique to each company, tailored to its specific operations, industry, and strategic choices.

- Authority: The authority behind accounting principles and policies indicates who sets these guidelines and procedures.

- Principles: Established by standard-setting bodies such as the Financial Accounting Standards Board (FASB) or the International Accounting Standards Board (IASB).

- Policies: Determined by a company’s management within the framework provided by the accounting principles.

- Flexibility: The flexibility of accounting principles and policies shows how rigid or adaptable these concepts are within the accounting framework.

- Principles: Generally less flexible, as they represent the foundational guidelines.

- Policies: More flexible, allowing companies to adapt them to their specific needs within the boundaries of the overarching principles.

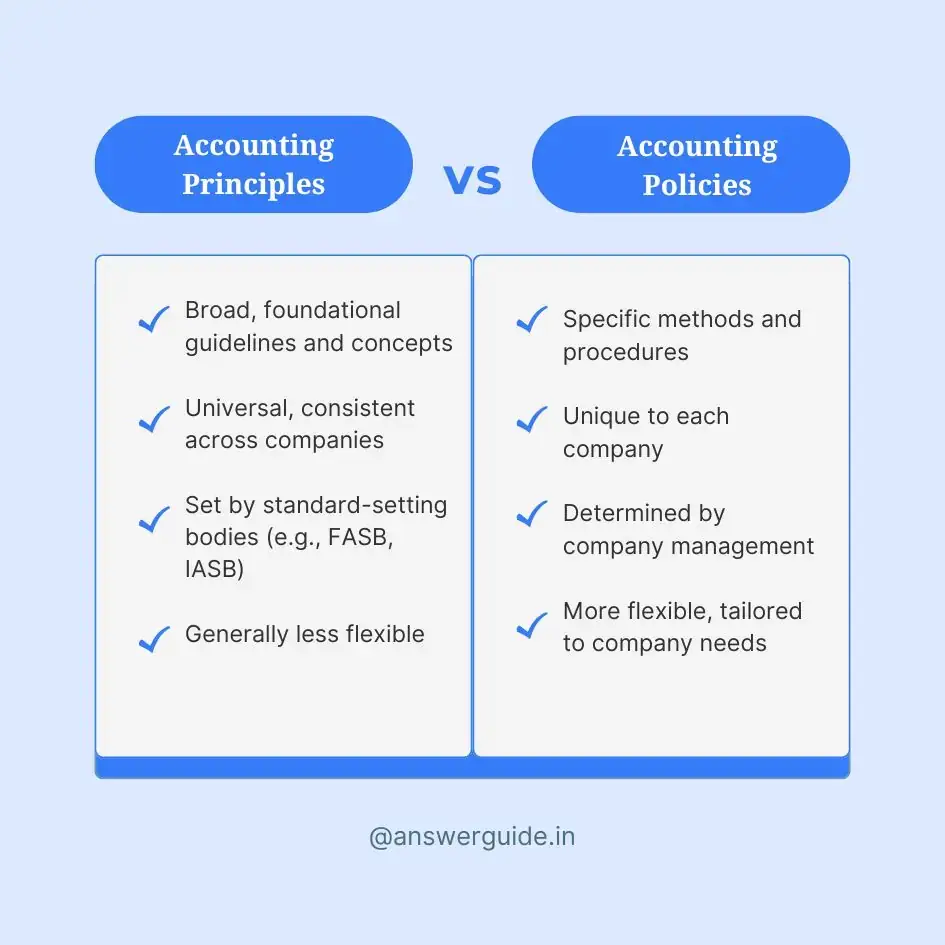

Table of Differences

| Aspect | Accounting Principles | Accounting Policies |

|---|---|---|

| Nature | Broad, foundational guidelines and concepts | Specific methods and procedures |

| Scope | Universal, consistent across companies | Unique to each company |

| Authority | Set by standard-setting bodies (e.g., FASB, IASB) | Determined by company management |

| Flexibility | Generally less flexible | More flexible, tailored to company needs |

Conclusion

Accounting principles provide the theoretical foundation for the practice of accounting, ensuring consistency and reliability across the field. Accounting policies, however, are the specific methods and practices that companies use to apply these principles, tailored to their individual needs and circumstances. Understanding the distinction between these two concepts is essential for accurately interpreting and preparing financial statements.