Understanding the difference between provisions and reserves is essential for anyone involved in financial management and reporting.

Both are crucial components of a company’s financial statements but serve different purposes and are treated differently in accounting.

This overview will define each term, outline their characteristics, and explain their differences with a summary table.

What Are Provisions in Accounting?

A provision is an amount set aside from a company’s profits to cover a future liability or potential loss that is likely to occur but has uncertain timing or amount.

Provisions are recognized as liabilities on the balance sheet and are expenses that reduce a company’s profit for the period in which they are recognized.

Common examples include provisions for bad debts, legal disputes, and warranty obligations.

What Are Reserves in Accounting?

A reserve, on the other hand, refers to a portion of a company’s profits that is retained in the business rather than being distributed to shareholders as dividends.

Reserves are created to strengthen the financial position of the company, fund future expansion, or cover unexpected contingencies.

Unlike provisions, reserves are not liabilities but rather part of the equity, and they appear under shareholders’ equity on the balance sheet.

Provision Vs Reserve

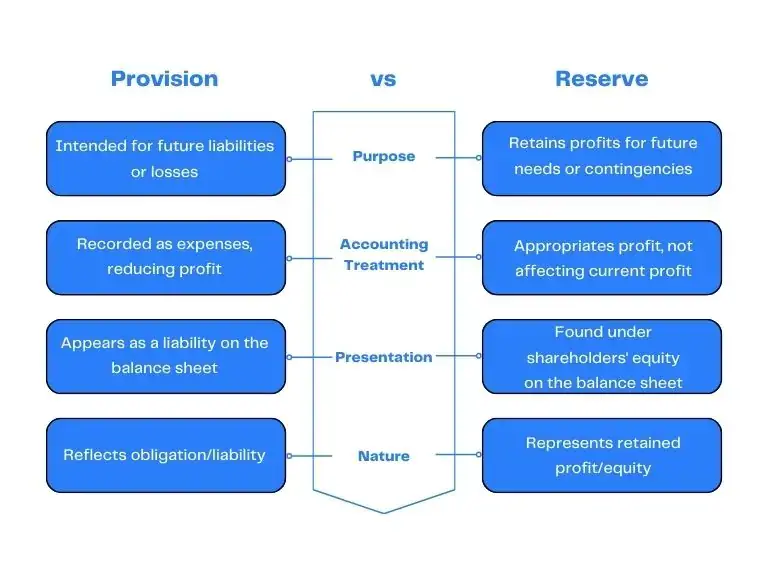

Provisions and reserves differ in their purpose, accounting treatment, and presentation on the financial statements.

Understanding these differences is important for accurately interpreting a company’s financial health and performance.

Purpose

The purpose of a provision is to account for probable future liabilities or losses, ensuring that financial statements present a true and fair view of the company’s financial position.

Reserves are meant to retain a portion of profits within the company to support future needs and enhance financial stability.

- Provision: To cover probable future liabilities or losses.

- Reserve: To retain profits for future needs or contingencies.

Accounting Treatment

Provisions are treated as expenses and reduce the company’s profit for the period in which they are recognized. They are recorded as liabilities on the balance sheet.

Reserves, in contrast, are appropriations of profit and do not affect the company’s profit for the period. They are recorded within shareholders’ equity.

- Provision: Recognized as an expense, reducing profit.

- Reserve: Appropriation of profit, not affecting profit.

Presentation on Financial Statements

Provisions appear as liabilities on the balance sheet, reflecting the company’s obligation to settle the anticipated liability or loss.

Reserves are shown under the equity section of the balance sheet, indicating retained earnings or profit appropriations.

- Provision: Appears as a liability on the balance sheet.

- Reserve: Appears under shareholders’ equity on the balance sheet.

Difference Between Provision and Reserve

| Aspect | Provision | Reserve |

|---|---|---|

| Purpose | To cover probable future liabilities or losses | To retain profits for future needs or contingencies |

| Accounting Treatment | Recognized as an expense, reducing profit | Appropriation of profit, not affecting profit |

| Presentation | Appears as a liability on the balance sheet | Appears under shareholders’ equity on the balance sheet |

| Nature | Obligation/liability | Retained profit/equity |

| Examples | Provisions for bad debts, legal disputes, warranties | General reserve, capital reserve, revenue reserve |

Conclusion

Provisions and reserves are both essential for prudent financial management but serve different roles.

Provisions address anticipated future liabilities, ensuring accurate financial reporting, while reserves help maintain financial stability and support future growth.

Understanding these distinctions is key to accurately interpreting a company’s financial statements and assessing its financial health.