Have you ever wondered what income tax is? It’s something that affects everyone who earns money, but understanding it can be a bit tricky.

Let’s break it down in simple terms so even kids can grasp it. Income tax is money you pay to the government from the money you earn.

This money is used to help pay for things like schools, roads, and hospitals. In India, we have a system in place to ensure that everyone pays their fair share based on how much they earn.

What Is Income Tax?

Income tax is a type of tax that governments impose on the income generated by businesses and individuals within their jurisdiction. This means that if you earn money, whether from a job, business, or investments, you have to pay a part of it to the government. This tax is usually collected once a year when you file your income tax return. This return is a form where you report your income and calculate how much tax you owe.

- Collected annually: Income tax is collected once a year through the filing of an income tax return. For example, every year, you need to report your earnings and calculate how much tax you owe by filing an income tax return with the government.

- Includes various income sources: Income tax applies to income in taxation from jobs, businesses, or investments. If you earn from a job, rent out a property, and make profits from investments, you must report all these earnings.

- Legal obligation: It is a legal requirement to file your income tax return if your income exceeds the specified limit set by the government. Failure to do so can result in penalties and legal action.

- Tax return form: The form used to report your income and taxes is known as the income tax return (ITR). This form varies based on the nature of income and the category of taxpayer.

- Revenue for government: The tax collected is a major source of revenue for the government to fund public services, such as education, healthcare, and infrastructure projects, benefiting society as a whole.

Income Tax Meaning and Definition

To put it simply, income tax is a percentage of your income that you pay to the government. The exact amount you pay depends on how much you earn and certain rules that apply to everyone. For example, if you earn more, you pay a higher percentage in taxes. This is because the government believes that those who earn more can afford to contribute more.

- Percentage of income: The tax you pay is a percentage of your total income. If you earn ₹10,00,000 in a year and fall into the 20% tax bracket, you would pay ₹2,00,000 in taxes, which goes to the government.

- Progressive tax system: Higher earnings result in a higher tax rate. Someone earning ₹20,00,000 will pay a higher percentage in taxes compared to someone earning ₹5,00,000, ensuring that those with higher incomes contribute more.

- Tax slabs: Income tax is calculated based on predefined tax slabs that determine the tax percentage on income for different income levels. These slabs help categorize taxpayers and apply appropriate tax rates.

- Deductions and exemptions: Various deductions and exemptions can reduce your taxable income, thereby reducing your tax liability. These can include expenses like medical costs, investments in specific schemes, and educational expenses.

- Mandatory contribution: It is a mandatory contribution to the government based on your earnings. By paying income tax, you help the government fund essential services and infrastructure projects.

Importance of Income Tax

Income tax importance cannot be overstated as it funds the services and infrastructure that we all use. Without income tax, the government wouldn’t have the money needed to build roads, run schools, or provide healthcare. It’s a way for everyone to contribute to the welfare of society. The money collected from income tax is used to build public schools and maintain infrastructure. National security and public healthcare systems are financed through income tax revenues, ensuring the smooth functioning of the country’s various essential services.

- Funds essential services: Income tax funds services like schools, roads, and hospitals. For example, the money collected from income tax is used to build public schools, maintain infrastructure, and support public healthcare systems.

- Supports government functions: Income tax ensures that the government has the necessary funds to operate and provide public goods. National security and public healthcare systems are financed through income tax revenues, ensuring the smooth functioning of the country’s various essential services.

- Public infrastructure: The revenue from income tax is used to develop and maintain public infrastructure like roads, bridges, and public transportation. This helps improve the overall quality of life for citizens.

- Social welfare programs: Income tax revenue supports social welfare programs, including healthcare, education, and housing for the underprivileged. These programs aim to reduce poverty and improve the standard of living for all citizens.

- Economic stability: A steady stream of tax revenue helps maintain economic stability by funding government operations and development projects. This ensures the country’s growth and prosperity.

Who Is Required to Pay Income Tax?

In India, anyone who earns income above a certain threshold is required to pay income tax. This includes individuals, Hindu Undivided Families (HUFs), companies, firms, LLPs, associations of persons, body of individuals, local authorities, and any other artificial juridical person. The income can be from salary, house property, business profits, capital gains, or other sources.

- Individuals and entities: Anyone earning income above a certain threshold must pay income tax. For instance, individuals, companies, HUFs, firms, LLPs, and local authorities are all required to pay income tax if their income exceeds the prescribed limit.

- Various income sources: Income can come from salaries, house property, business profits, capital gains, or other sources. A person earning a salary, rental income from a property, and profits from a business must pay income tax on all these sources.

- Income threshold: The requirement to pay income tax applies to those whose income exceeds the specified limit set by the government. This threshold can vary based on the type of taxpayer and their income sources.

- Non-residents: Non-residents with income earned in India are also required to pay income tax. This ensures that all individuals and entities earning income within India contribute to the country’s revenue.

- Self-employed individuals: Self-employed individuals and freelancers must also pay income tax on their earnings. They need to calculate their income and expenses accurately to determine their taxable income.

Income Tax Act

The Income Tax Act of 1961 is the law that governs income tax in India. It lays down the rules, rates, and regulations for the assessment, collection, and recovery of income tax. It is a comprehensive act that covers various aspects of income tax, including the different heads of income, exemptions, deductions, and penalties for non-compliance.

- Governing law: The Income Tax Act of 1961 governs income tax in India. This Act provides the rules, rates, and regulations for income tax assessment and collection, ensuring consistency and fairness in the tax system.

- Comprehensive coverage: It covers various aspects like income heads, exemptions, deductions, and penalties. The Act specifies the tax treatment for different types of income, such as salary, business income, and capital gains, providing clarity for taxpayers.

- Amendments: The Act is periodically amended to incorporate changes in tax laws and policies. These amendments ensure that the tax system remains relevant and effective in addressing new economic realities.

- Tax administration: It outlines the administrative framework for the collection and enforcement of income tax. This includes the roles and responsibilities of the Income Tax Department and other authorities involved in tax administration.

- Legal framework: The Act provides the legal framework for tax assessment, appeals, and dispute resolution. It ensures that taxpayers have recourse to legal remedies in case of disputes with tax authorities.

Income Tax Return (ITR)

An income tax return (ITR) is a form used to report your income and taxes paid to the Income Tax Department. It includes details about your income, expenses, and investments for a particular financial year. Filing an ITR is mandatory for individuals and businesses whose income exceeds the prescribed limit. There are different types of ITR forms based on the nature of income and category of taxpayer.

- Reporting income and taxes: An ITR is a form used to report income and taxes paid to the Income Tax Department. Filing an ITR includes details of your income, expenses, and investments for a financial year, ensuring transparency and accuracy in tax reporting.

- Different forms: Various forms exist based on income nature and taxpayer category. For example, ITR-1 is for individuals with income from salary, while ITR-4 is for those opting for the presumptive income scheme. Choosing the correct form is crucial for accurate tax filing.

- Mandatory filing: Filing an ITR is mandatory for individuals and businesses whose income exceeds the prescribed limit. This helps the government keep track of taxpayers’ income and ensures compliance with tax laws.

- Annual requirement: ITRs must be filed annually, providing a summary of your financial activities for the year. This helps the government assess and collect the appropriate amount of tax from each taxpayer.

- Compliance: Filing an ITR ensures compliance with tax laws and helps avoid penalties for non-filing. It also provides a record of your income and tax payments, which can be useful for financial planning and obtaining loans.

e-Filing Income Tax

e-Filing is the process of electronically submitting your income tax return (ITR) online. It is a convenient and efficient way to file your taxes. The Income Tax Department of India has made e-filing mandatory for most taxpayers, especially those with an income above ₹5 lakh or those seeking a refund. The process involves

registering on the e-filing portal, filling out the appropriate ITR form, and submitting it online.

- Electronic submission: e-Filing is the process of submitting your ITR online. You can file your ITR electronically through the Income Tax Department’s official website, which simplifies the process and reduces paperwork.

- Mandatory for most taxpayers: e-Filing is mandatory for most taxpayers, especially those with an income above ₹5 lakh or those seeking a refund. This ensures that the filing process is streamlined and efficient for a large number of taxpayers.

- User-friendly process: The e-filing portal is designed to be user-friendly, making it easy for taxpayers to navigate and file their returns. The portal provides step-by-step guidance and support to help you complete your ITR accurately.

- Instant acknowledgment: Upon successful submission, you receive an instant acknowledgment of your filed return. This serves as proof of filing and can be used for future reference or verification purposes.

- Secure and confidential: The e-filing process is secure and ensures the confidentiality of your financial information. The portal uses encryption and other security measures to protect your data from unauthorized access.

Income Tax Calculation

Calculating income tax might sound complicated, but it becomes simpler once you understand the steps. Here’s how you can calculate your income tax in India: First, list all the money you earned in a year from various sources like salary, business, or investments. Then, subtract any deductions you are eligible for from your total income. Deductions can include things like medical expenses, investment in certain savings schemes, and educational expenses. Once you have your adjusted gross income (AGI), you apply the tax rate based on the tax slab your income falls into.

- Add up your income: List all the money you earned in a year from various sources like salary, business, or investments. This gives you a total income figure, which is the starting point for calculating your income tax.

- Calculate adjusted gross income (AGI): Subtract any deductions you are eligible for from your total income. For example, deductions can include medical expenses, investments in certain savings schemes, and educational expenses. This gives you your AGI.

- Apply the tax rate: Apply the tax rate based on the tax slab your income falls into. If your total income is ₹10,00,000 and you have deductions worth ₹2,00,000, your AGI is ₹8,00,000. Based on the tax slab, you apply the relevant tax rate to ₹8,00,000.

- Use tax calculators: Utilize online tax liability calculators to estimate your tax liability accurately. These tools can help you determine how much tax you owe based on your income and deductions.

- Consider exemptions: Factor in any applicable exemptions that can further reduce your taxable income. Exemptions can include things like HRA, LTA, and other allowances provided by your employer.

About Income Tax Department, India

The Income Tax Department of India is the government agency responsible for the administration and collection of direct taxes, including income tax. It operates under the Department of Revenue in the Ministry of Finance. The department’s main functions include tax assessment, collection, enforcement of tax laws, and taxpayer assistance.

- Government agency: Responsible for the administration and collection of direct taxes. For instance, the department ensures compliance with income tax laws and assists taxpayers in filing their returns.

- Functions: Includes tax assessment, collection, enforcement of tax laws, and taxpayer assistance. The department operates under the Department of Revenue in the Ministry of Finance, providing essential services to taxpayers.

- Taxpayer services: Provides various services to taxpayers, including help desks, online tools, and resources for filing returns. These services aim to make the tax filing process easier and more accessible for all taxpayers.

- Compliance monitoring: Monitors compliance with tax laws and takes action against tax evasion and non-compliance. This ensures that all taxpayers adhere to the laws and contribute their fair share.

- Policy implementation: Implements tax policies and regulations as prescribed by the government. The department ensures that tax policies are effectively enforced and that taxpayers are aware of their obligations.

Income Tax Payment Details

Income tax can be paid online or offline. Online payment can be made through the official Income Tax Department website using net banking, debit cards, or credit cards. Offline payment can be made at designated banks through challan forms. It’s important to pay your taxes on time to avoid penalties and interest on late payments.

- Payment methods: Options for paying income tax online and offline. For example, you can pay online through net banking or visit a bank to pay via challan. These options provide flexibility and convenience for taxpayers.

- Timely payment: It’s crucial to pay taxes on time to avoid penalties and interest on late payments. This ensures compliance and avoids additional financial burdens, making it easier to manage your finances.

- Online convenience: Online payment methods offer convenience and instant confirmation of payment. This allows taxpayers to complete their payments quickly and securely from the comfort of their homes.

- Offline options: Offline payment can be made through designated banks using challan forms. This option is available for those who prefer traditional methods of payment.

- Installment payments: In certain cases, taxpayers can opt for installment payments to manage their tax liability. This option can be helpful for those who find it difficult to pay their entire tax liability in one go.

Income Tax Forms List

The Income Tax Department has prescribed different forms for filing returns based on the nature of income and category of taxpayer. Some common forms include:

- ITR-1 (SAHAJ): For individuals having income from salary, one house property, and other sources. This form is designed for salaried individuals with simple income structures.

- ITR-2: For individuals and HUFs not having income from business or profession. This form is suitable for those with income from capital gains, multiple properties, and other sources.

- ITR-3: For individuals and HUFs having income from business or profession. This form is used by self-employed individuals, professionals, and those with business income.

- ITR-4 (SUGAM): For individuals, HUFs, and firms opting for the presumptive income scheme. This form simplifies the filing process for small businesses and professionals with lower turnover.

- ITR-5: For firms, LLPs, AOPs, BOIs, and other non-individual taxpayers. This form caters to entities that are not individual taxpayers but need to file returns.

Investment Options for Income Tax Saving in 2024

There are various investment options available that can help you save on taxes. Investing in these options not only helps you save on taxes but also helps in wealth creation.

- Public Provident Fund (PPF): Investment in PPF is eligible for deduction under section 80C. PPF offers tax-free interest and provides a secure long-term investment option.

- National Savings Certificate (NSC): Investment in NSC qualifies for deduction under section 80C. NSC offers guaranteed returns and is a safe investment choice for risk-averse investors.

- Equity-Linked Savings Scheme (ELSS): ELSS funds offer tax benefits under section 80C. These funds invest in equities and have the potential for higher returns, along with tax benefits.

- Tax-saving Fixed Deposits: Deposits with a lock-in period of 5 years are eligible for deduction under section 80C. These fixed deposits provide stable returns and tax benefits.

- National Pension System (NPS): Contributions to NPS are eligible for deduction under section 80CCD(1B). NPS helps in building a retirement corpus while offering tax benefits.

Income Tax Deduction Section List

Here are some common sections under which you can claim deductions. These deductions help reduce your taxable income, thereby reducing the tax payable.

- Section 80C: Deduction for investment in PPF, NSC, ELSS, etc. This section allows a maximum deduction of ₹1.5 lakh annually, encouraging savings and investments.

- Section 80D: Deduction for health insurance premiums. You can claim deductions for premiums paid for yourself, your spouse, children, and parents.

- Section 80E: Deduction for interest on education loan. This section helps in reducing the financial burden of education loans by allowing deductions for the interest paid.

- Section 80G: Deduction for donations to certain funds and charities. Donations to eligible charitable organizations can be claimed as deductions, promoting philanthropy.

- Section 80TTA: Deduction for interest on savings accounts. This section allows a deduction of up to ₹10,000 for interest earned on savings accounts.

Income Tax Benefits on Life Insurance

Premiums paid for life insurance policies are eligible for deduction under section 80C. The deduction is available for policies taken for yourself, your spouse, or your children. The maximum deduction allowed under section 80C is ₹1.5 lakh per year.

- Premiums paid for life insurance: Eligible for deduction under section 80C. For instance, if you pay life insurance premiums for yourself, your spouse, or your children, you can claim a deduction for these premiums.

- Maximum deduction: The maximum deduction allowed under section 80C is ₹1.5 lakh per year. This helps reduce your taxable income and overall tax liability.

- Eligibility: Deductions can be claimed for premiums paid towards life insurance policies taken for yourself, your spouse, or your children.

- Tax-saving instrument: Life insurance policies serve as both a protection plan and a tax-saving instrument. This dual benefit makes life insurance an attractive investment option.

- Claiming process: The process to claim the deduction involves submitting proof of premium payments while filing your ITR. Ensure you have the necessary documents to support your claim.

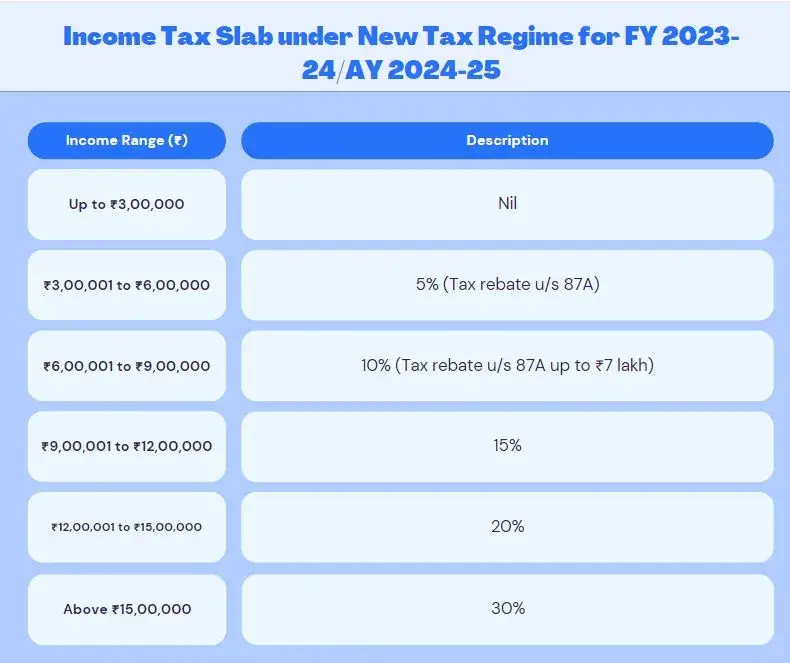

Income Tax Slab under New Tax Regime for FY 2023-24/AY 2024-25

The new tax regime offers a simpler structure with reduced tax rates but fewer deductions and exemptions. Here’s a detailed explanation of the income tax slabs under this regime:

| Income Range (₹) | Tax Rate |

|---|---|

| Up to ₹3,00,000 | Nil |

| ₹3,00,001 to ₹6,00,000 | 5% (Tax rebate u/s 87A) |

| ₹6,00,001 to ₹9,00,000 | 10% (Tax rebate u/s 87A up to ₹7 lakh) |

| ₹9,00,001 to ₹12,00,000 | 15% |

| ₹12,00,001 to ₹15,00,000 | 20% |

| Above ₹15,00,000 | 30% |

Explanation:

- Up to ₹3,00,000 – Nil:

- Individuals with an annual income up to ₹3,00,000 are not required to pay any income tax. This threshold provides relief to low-income earners, ensuring they are not burdened by tax.

- ₹3,00,001 to ₹6,00,000 – 5% (Tax rebate u/s 87A):

- Income falling within this range is taxed at 5%. However, individuals eligible for the rebate under section 87A can reduce their tax liability. The rebate ensures that individuals with an annual income up to ₹5,00,000 do not have to pay tax, effectively making the tax rate nil for them.

- ₹6,00,001 to ₹9,00,000 – 10% (Tax rebate u/s 87A up to ₹7 lakh):

- Income within this bracket is taxed at 10%. The rebate under section 87A is applicable up to an income of ₹7,00,000, reducing the effective tax for eligible individuals.

- ₹9,00,001 to ₹12,00,000 – 15%:

- Individuals earning between ₹9,00,001 and ₹12,00,000 are taxed at 15%. This rate reflects a moderate increase, ensuring higher earners contribute more without a steep hike.

- ₹12,00,001 to ₹15,00,000 – 20%:

- For this income range, the tax rate is set at 20%. This higher rate ensures that those with significant earnings pay a proportionately larger share of taxes.

- Above ₹15,00,000 – 30%:

- Income exceeding ₹15,00,000 is taxed at the highest rate of 30%. This progressive rate ensures that high-income earners contribute the most to the national revenue, aligning with the principles of equity and fairness.

This new tax regime simplifies the process by providing clear tax rates for different income levels, making it easier for taxpayers to understand their liabilities. However, it is important to consider that this regime offers limited deductions and exemptions compared to the old regime. Taxpayers need to evaluate which regime is more beneficial based on their income and eligible deductions.

How to File ITR Online?

Filing your income tax return (ITR) online is simple. Here’s a step-by-step guide:

- Register on the e-Filing Portal: Visit the official Income Tax Department e-filing website and register using your PAN. This step involves providing your personal details, contact information, and creating a password for your account.

- Login: Use your credentials to log in to the portal. After registration, log in to the e-filing portal using your PAN as the user ID and the password you created during registration.

- Select the ITR Form: Choose the appropriate ITR form based on your income. The portal will suggest the form suitable for your income type. For example, ITR-1 is for individuals with income from salary, while ITR-4 is for those opting for the presumptive income scheme.

- Fill in the Details: Enter your personal information, income details, deductions, and tax paid. Make sure to gather all necessary documents, such as Form 16 from your employer, bank statements, and investment proofs, to accurately fill in the details.

- Verify the Information: Double-check all the details entered to ensure accuracy. Errors can lead to processing delays or rejection of your return.

- Submit the Form: Submit the form online. Once you are satisfied that all information is accurate, submit your ITR form. You will receive an acknowledgment receipt upon successful submission.

- E-Verify: Complete the e-verification process using Aadhaar OTP, net banking, or other available methods. E-verification is essential to complete the filing process. It can be done instantly using Aadhaar OTP or through net banking.

- Gather documents: Before you start, gather all necessary documents, such as Form 16, bank statements, and investment proofs. This ensures that you have all the required information at hand to complete your ITR accurately.

- Choose the right ITR form: Selecting the correct ITR form is crucial based on your income sources. The portal guides you in choosing the appropriate form, but understanding the options helps in making the right choice.

- Save your work: Save your progress frequently to avoid data loss. The e-filing portal allows you to save your work and continue later, ensuring you don’t lose any information if you need to take a break.

- Seek assistance if needed: If you are unsure about any step, seek help from a tax consultant or use online guides. The Income Tax Department provides resources and support to help you file your return accurately.

- Keep acknowledgment safe: After submission, save the acknowledgment receipt for future reference. This document is proof of filing and can be used for verification or in case of any queries from the tax department.

Best Way to Save on Taxes

Saving on taxes requires smart planning and taking advantage of the available deductions and exemptions. Here are some of the best ways to save on taxes:

- Invest in tax-saving instruments: Investments like PPF, NSC, and ELSS can help you save on taxes while building wealth. These instruments offer tax benefits under section 80C and can significantly reduce your taxable income.

- Claim deductions under section 80C: You can claim deductions up to ₹1.5 lakh under section 80C for various investments and expenses. This includes contributions to PPF, NSC, ELSS, life insurance premiums, and more.

- Take health insurance: Premiums paid for health insurance are eligible for deduction under section 80D. This not only provides financial protection in case of medical emergencies but also helps reduce your tax liability.

- Education loan interest: The interest paid on education loans is deductible under section 80E. This deduction is available for a maximum of 8 years or until the interest is fully repaid, whichever is earlier.

- Donate to charity: Donations to eligible funds and charities can be claimed as deductions under section 80G. This encourages philanthropy and allows you to support causes you care about while reducing your taxable income.

Ways to Reduce Taxable Income

Reducing your taxable income can significantly lower your tax liability. Here are some ways to reduce taxable income:

- Maximize deductions: Take advantage of all available deductions to lower your taxable income. This includes deductions under sections 80C, 80D, 80E, and more. Each deduction reduces your taxable income, thereby lowering the tax you owe.

- Invest in retirement funds: Contributions to retirement funds like NPS can reduce your taxable income. NPS offers additional tax benefits under section 80CCD(1B), allowing an extra deduction of up to ₹50,000.

- Use tax-free investments: Invest in tax-free bonds and other instruments to earn income without increasing your tax liability. Interest earned on these investments is exempt from tax, making them a smart choice for tax planning.

- Claim house rent allowance (HRA): If you are paying rent, you can claim HRA to reduce your taxable income. The exemption is calculated based on your salary, rent paid, and location of residence.

- Use home loan interest: The interest paid on home loans is deductible, which can help reduce your taxable income. Under section 24(b), you can claim a deduction of up to ₹2 lakh on interest paid on home loans for a self-occupied property.

Explain Capital Gains Tax

Explain capital gains tax: Capital gains tax is the tax levied on the profit made from the sale of assets like property, stocks, or bonds. There are two types of capital gains: short-term and long-term. Short-term capital gains are taxed at a higher rate compared to long-term capital gains.

- Short-term capital gains: Gains from assets held for less than 36 months are considered short-term and are taxed at the applicable income tax rate. These gains are added to your total income and taxed according to your income slab.

- Long-term capital gains: Gains from assets held for more than 36 months are considered long-term and are taxed at a lower rate. For example, long-term capital gains on the sale of equity shares are taxed at 10% if the gains exceed ₹1 lakh.

- Exemptions: Certain exemptions are available under sections 54, 54EC, and 54F for reinvesting the gains in specified assets. These exemptions can help reduce or eliminate the tax liability on long-term capital gains.

- Indexation benefit: Long-term capital gains on certain assets like real estate are eligible for indexation benefit, which adjusts the purchase price for inflation. This reduces the taxable gain and the overall tax liability.

- Reporting capital gains: Capital gains must be reported in your ITR and the applicable tax paid to avoid penalties. Ensure you keep records of all transactions and calculate the gains accurately.

Conclusion

Understanding income tax might seem daunting at first, but breaking it down into simpler parts makes it easier to grasp. Remember, paying taxes is a way to contribute to the development of the country. By planning wisely, you can also save a significant amount on your taxes. Use this guide to help you navigate through the basics of income tax and make informed decisions.

This comprehensive blog post has covered the basic concept of income tax, its importance, different types of income tax, and how to calculate and save on taxes. By following these guidelines and using the tools available, such as a tax liability calculator and a personal tax planner, you can manage your tax obligations more efficiently and ensure compliance with the law.